Services

We are a full-service firm providing consulting services in many areas of real estate and specializing in property tax appeals.

PROPERTY TAX APPEALS

For most commercial properties, property taxes are the single largest expense item on an operating statement. Florida property tax rates are among the highest in the United States. FPTC’s knowledge and experience with the tax appeal process guarantees to minimize your property tax burden with the highest quality service. We are committed to making sure that our clients do not pay more in taxes than necessary.

Property Tax Forecasting

Companies typically lack the internal resources to estimate future property taxes. We provide you with peace of mind by accurately estimating future tax liabilities for all aspects of your property acquisition or development. Knowing your tax liability will help maximize your investment.

Tangible Personal

Property

Tangible Personal Property is defined as an ad valorem tax assessment based on the value of the furniture, fixtures and equipment owned by a business or rental property. FPTC offers unique minimization solutions to reduce your personal property tax bill.

Exemptions

We help our clients take advantage of various property tax exemptions such as homestead, portability, agricultural, hospitals, educational, religious, low-income housing, seniors, widows and more.

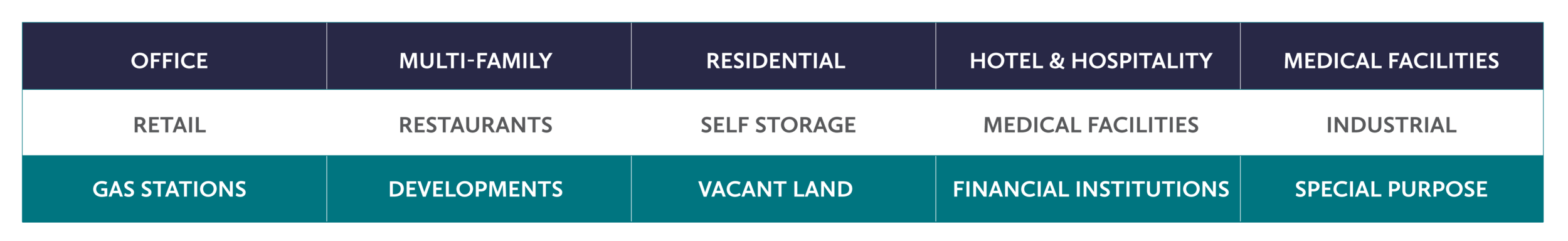

Who We Service

Our clients range from global corporations to small businesses, single-house owners, developers, investors, and property managers. We handle all types of properties, including but not limited to: